1099 Forms 2024

For information returns for example Form 1099 series required to be filed on or after January 1 2024 the final regulations reduce the 250 return threshold enacted in prior regulations to generally require electronic filing by filers of 10 or more returns in a calendar year Starting January 1, 2024, entities with 10 or more forms in total (including various form types like Form 1042-S, Form 1099 series, and Form W-2) will need to file electronically. Form W-9 : The ...

Beginning in January 2024 for the Tax Year 2023 and beyond any filer submitting 10 or more information returns TOTAL during a calendar year is mandated to e file those returns Additionally if the original return was required to be submitted electronically any corrected information returns also must be e filed Filing and reporting rules for Forms 1099-MISC, Miscellanous Income, and 1099-NEC, Nonemployee Compensation, are changing in the coming year, and employers should be aware of the new requirements, a payroll practitioner said May 17. ... Beginning in 2024 for information returns filed for tax year 2023, including Forms 1099-MISC and 1099-NEC ...

1099 Forms 2024

A 1099 form is a tax record that an entity or person not your employer gave or paid you money See how various types of IRS Form 1099 work Don t miss out during the 2024 tax season 1099 letter request sample w 9 request letter doc sample w 9 request letter date dear vendor. What is a 1099 misc form financial strategy centerFillable form 1099 nec form resume examples o7y3lqkvbn.

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

1099 Forms Reporting To IRS E file Form 1099 Series Online

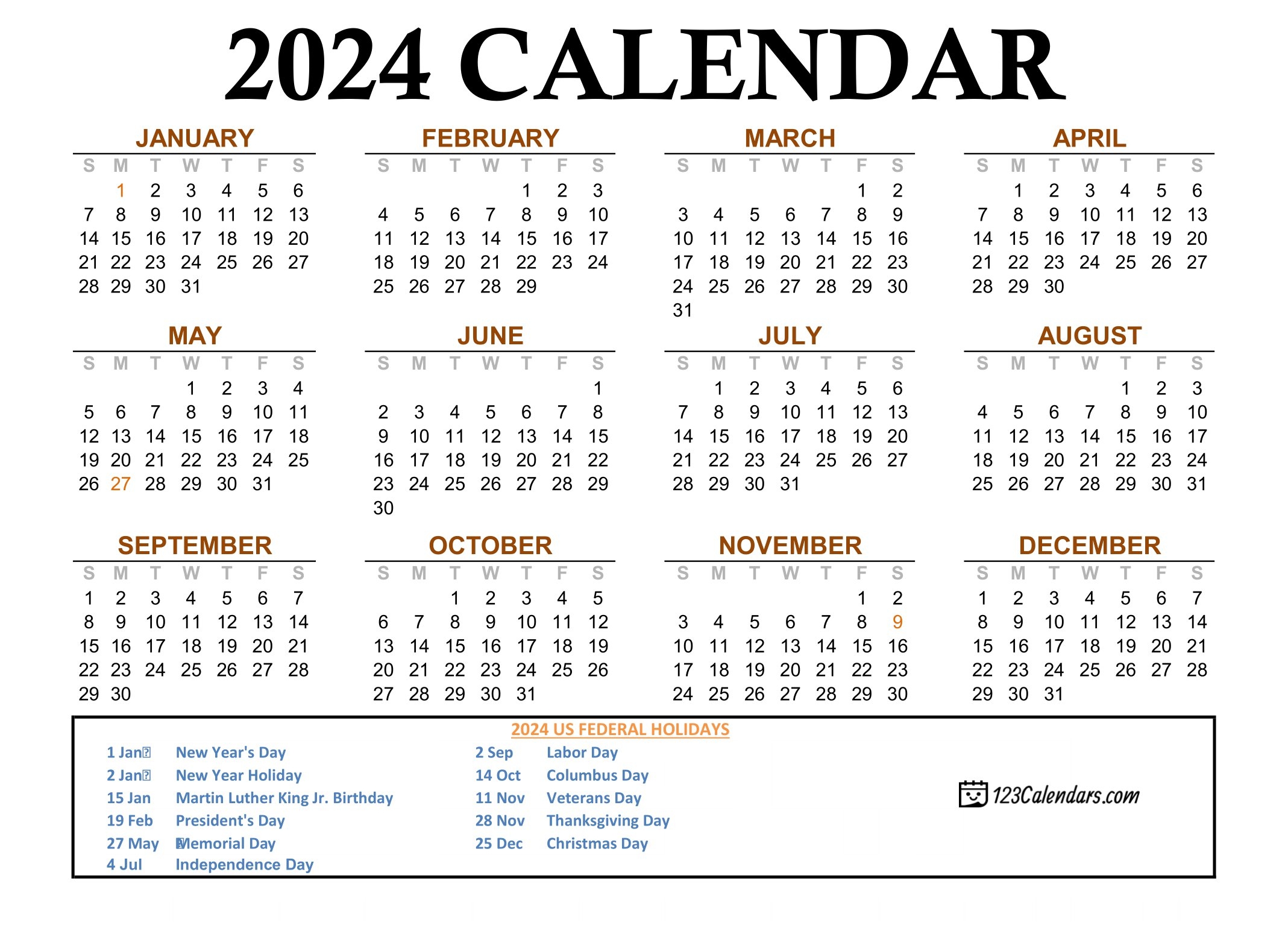

Form 1099 INT February 28 2024 April 1 2024 January 31 2024 ACA Form 1095 B 1095 C February 28 2024 April 1 2024 March 1 2024 Filing Season 2024 Deadlines TY2023 Please note that these are just the federal deadlines Please verify with your state for any state requirements and the proper submission methods If you don't pay your estimated tax by Jan. 15, you must file your 2023 return and pay all tax due by March 1, 2024 to avoid an estimated tax penalty. Social Security, Medicare, and withheld income tax. ... Furnish Form 1099-NEC information returns for 2023 to payees of nonemployee compensation and file returns with the IRS. File Form 945, ...

the taxes you file in 2024 The IRS typically opens for the season in January but TurboTax will be accepting returns and ready to help you prepare your tax return in early January TPSOs will not be required to report tax year 2023 transactions on a Form 1099 K to the IRS or the payee for the lower over 600 threshold amount enacted as Millions more freelancers, gig workers, and other taxpayers will be getting IRS 1099-K tax reporting forms next year due to a change in the law that broadens the scope of who must complete the document. E-commerce platforms like Venmo, PayPal Holdings Inc., and eBay Inc. starting in 2024 are required to send 1099-K tax forms to users who have ...